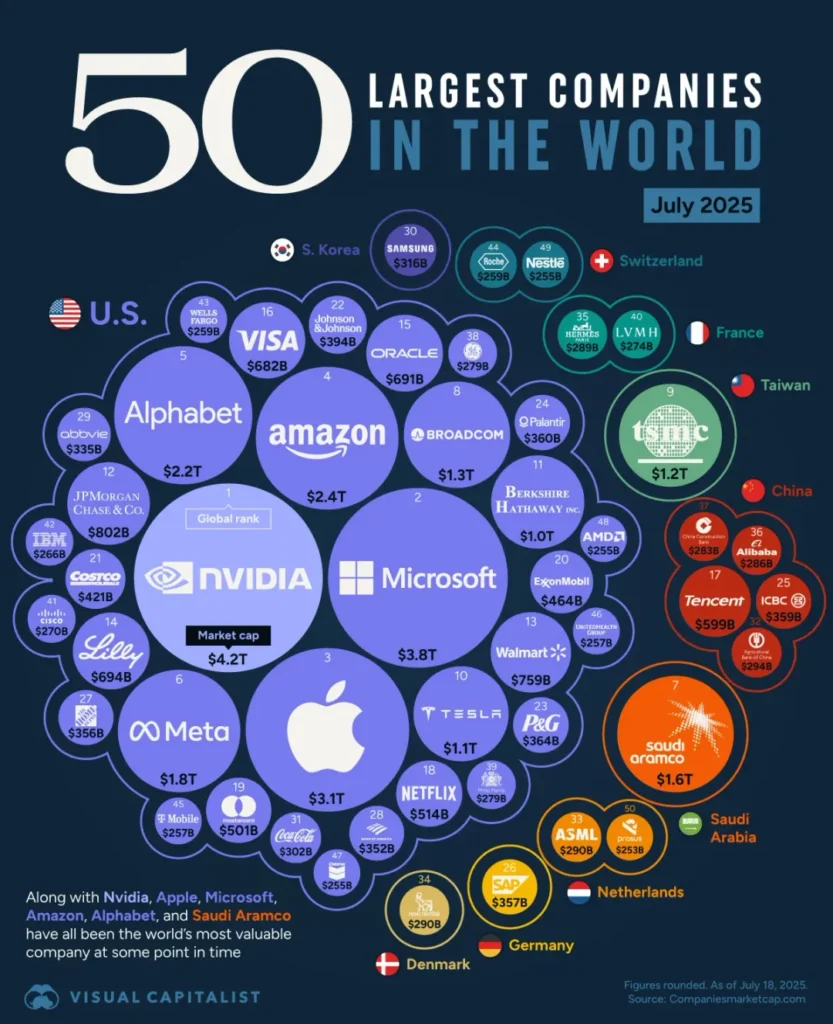

Nvidia just crossed a massive milestone—its market valuation has now topped $4 trillion, making it the most valuable company in the world as of July 18, 2025.

That puts it ahead of big names like Apple, Microsoft, and Google, and places it at the very top of the list of the world’s 50 most valuable companies. In fact, 34 of those 50 are American, showing just how dominant U.S. tech companies remain. But right behind them, Saudi Aramco is still the largest non-U.S. company, sitting at a $1.6 trillion market cap.

📌 Curious about where other tech giants stand? Check out our Tech section for the latest insights.

Why Is Nvidia So Valuable Right Now?

Nvidia’s revenue for fiscal year 2025 hit $115 billion—doubling from last year. That’s a huge jump and definitely worth celebrating.

But here’s something to consider: Apple pulled in nearly $100 billion in profit alone back in 2022. That means Nvidia is still behind in terms of raw financial performance.

So, what’s really driving Nvidia’s skyrocketing stock price?

Investors Are Betting on the Future

Stock prices don’t always reflect the present—they reflect expectations. Investors believe Nvidia’s AI chips are essential to the future of technology, from cloud computing to self-driving cars and everything in between.

The logic is simple: if demand for AI continues to explode, Nvidia’s chips will be at the heart of that growth—and the company could get even bigger.

But that also means one thing: this $4 trillion valuation is only justified if Nvidia keeps growing this fast.

What Could Go Wrong?

While Nvidia is in a great position, it’s not without risk. There are a few things that could slow it down:

- Tough competition from other chipmakers like AMD and Intel

- Regulatory pressure as governments look to control AI development

- Market saturation if the AI boom slows down or hits a ceiling

It’s clear that Nvidia is leading the pack—for now. But staying at the top won’t be easy.

Dataset

| Rank | Name | Country | Market Cap | Price/Sh (USD) |

| 1 | NVIDIA | 🇺🇸 U.S. | $4.2T | $172.04 |

| 2 | Microsoft | 🇺🇸 U.S. | $3.8T | $511.73 |

| 3 | Apple | 🇺🇸 U.S. | $3.1T | $210.89 |

| 4 | Amazon | 🇺🇸 U.S. | $2.4T | $225.88 |

| 5 | Alphabet | 🇺🇸 U.S. | $2.2T | $185.66 |

| 6 | Meta Platforms | 🇺🇸 U.S. | $1.8T | $702.00 |

| 7 | Saudi Aramco | 🇸🇦 Saudi Arabia | $1.6T | $6.43 |

| 8 | Broadcom | 🇺🇸 U.S. | $1.3T | $283.10 |

| 9 | TSMC | 🇹🇼 Taiwan | $1.2T | $240.33 |

| 10 | Tesla | 🇺🇸 U.S. | $1.1T | $329.67 |

| 11 | Berkshire Hathaway | 🇺🇸 U.S. | $1.0T | $474.20 |

| 12 | JPMorgan Chase | 🇺🇸 U.S. | $801.5B | $291.48 |

| 13 | Walmart | 🇺🇸 U.S. | $759.3B | $95.15 |

| 14 | Eli Lilly | 🇺🇸 U.S. | $694.2B | $773.29 |

| 15 | Oracle | 🇺🇸 U.S. | $690.9B | $245.98 |

| 16 | Visa | 🇺🇸 U.S. | $681.5B | $348.88 |

| 17 | Tencent | 🇨🇳 China | $599.2B | $66.06 |

| 18 | Netflix | 🇺🇸 U.S. | $513.9B | $1,207.52 |

| 19 | Mastercard | 🇺🇸 U.S. | $500.9B | $551.62 |

| 20 | Exxon Mobil | 🇺🇸 U.S. | $464.3B | $107.74 |

| 21 | Costco | 🇺🇸 U.S. | $421.4B | $950.25 |

| 22 | Johnson & Johnson | 🇺🇸 U.S. | $394.4B | $163.91 |

| 23 | Procter & Gamble | 🇺🇸 U.S. | $363.7B | $155.11 |

| 24 | Plantir | 🇺🇸 U.S. | $360.1B | $152.58 |

| 25 | ICBC | 🇨🇳 China | $359.0B | $0.79 |

| 26 | SAP | 🇩🇪 Germany | $357.2B | $305.57 |

| 27 | Home Depot | 🇺🇸 U.S. | $356.3B | $358.08 |

| 28 | Bank of America | 🇺🇸 U.S. | $352.2B | $47.36 |

| 29 | AbbVie | 🇺🇸 U.S. | $334.7B | $189.47 |

| 30 | Samsung | 🇰🇷 South Korea | $316.1B | $48.23 |

| 31 | Coca-Cola | 🇺🇸 U.S. | $301.7B | $70.09 |

| 32 | Agricultural Bank of China | 🇨🇳 China | $293.7B | $0.87 |

| 33 | ASML | 🇳🇱 Netherlands | $290.2B | $738.06 |

| 34 | Novo Nordisk | 🇩🇰 Denmark | $289.7B | $64.41 |

| 35 | Hermès | 🇫🇷 France | $288.6B | $2,752.97 |

| 36 | Alibaba | 🇨🇳 China | $286.4B | $120.05 |

| 37 | China Construction Bank | 🇨🇳 China | $283.1B | $1.35 |

| 38 | General Electric | 🇺🇸 U.S. | $279.0B | $263.14 |

| 39 | Philip Morris International | 🇺🇸 U.S. | $278.7B | $179.04 |

| 40 | LVMH | 🇫🇷 France | $273.6B | $549.84 |

| 41 | Cisco | 🇺🇸 U.S. | $269.7B | $68.11 |

| 42 | IBM | 🇺🇸 U.S. | $265.8B | $285.96 |

| 43 | Wells Fargo | 🇺🇸 U.S. | $259.4B | $80.56 |

| 44 | Roche | 🇨🇭 Switzerland | $258.9B | $322.65 |

| 45 | T-Mobile US | 🇺🇸 U.S. | $257.3B | $226.58 |

| 46 | UnitedHealth | 🇺🇸 U.S. | $256.5B | $282.73 |

| 47 | Chevron | 🇺🇸 U.S. | $255.2B | $147.35 |

| 48 | AMD | 🇺🇸 U.S. | $255.1B | $157.34 |

| 49 | Nestlé | 🇨🇭 Switzerland | $254.9B | $97.01 |

| 50 | Prosus | 🇳🇱 Netherlands | $253.1B | $57.93 |

Data sources

Figures rounded. As of July 18, 2025.

https://companiesmarketcap.com